Levy Foxx: Unraveling The Power Of Imposition And Collection

In a world increasingly shaped by economic forces and governmental actions, understanding fundamental concepts like "levy" is not merely an academic exercise but a practical necessity. The term "levy" carries significant weight, encompassing a broad spectrum of meanings from financial obligations to military conscription. To truly grasp its multifaceted nature, we embark on a comprehensive exploration, which we'll refer to as the "Levy Foxx" framework – a conceptual lens designed to illuminate the historical, financial, and societal implications of this powerful instrument.

From ancient legions funded by farmer-soldiers to modern-day taxes on oil imports, the concept of a levy has consistently played a pivotal role in shaping societies, economies, and even the course of history. This article delves deep into the essence of a levy, distinguishing it from other financial obligations, tracing its historical roots, and examining its contemporary relevance. Through the "Levy Foxx" perspective, we aim to provide a clear, authoritative, and trustworthy understanding of how levies impact individuals, businesses, and nations.

Table of Contents

- Understanding the Core: What Exactly is a Levy?

- The Historical Echoes: Levies in Military Contexts

- Financial Levies: Beyond Just Taxes

- The Legal Framework: Imposing and Collecting Levies

- Levy Foxx: A Conceptual Framework for Understanding Levies

- The Societal Impact of Levies

- Navigating the World of Levies: Practical Insights

- Future Perspectives on Levies

Understanding the Core: What Exactly is a Levy?

The word "levy" is rich with meaning, often evoking images of financial burdens or historical military actions. At its most fundamental, a levy signifies the imposition or collection of an assessment. This assessment can take various forms, from a monetary charge to the enlistment of personnel. The core idea is that something is being "raised" or "collected" by authority or force.Levy as a Financial Imposition

One of the most common understandings of "levy" pertains to financial obligations. An amount of money, such as a tax, that you have to pay to a government or organization, is a prime example. It is a sum of money that you have to pay, for example as a tax to the government. This could be an extra amount of money that has to be paid, especially as a tax to the government. For instance, putting or imposing a levy on oil imports is a clear illustration of this financial application. Such levies are typically established by a governing body or an institution, making them a formal and often mandatory charge. They are distinct from voluntary contributions; rather, they are enforced.Levy in the Context of Force and Authority

Beyond financial matters, "levy" also carries connotations of authority and force. It can mean to impose a tax, fine, or other punishment on a person or business. This highlights the coercive power behind a levy – it's not merely a request but an enforced action. The act of imposing or collecting, as of a tax, by authority or force, underscores the governmental or institutional power involved. This aspect of force extends beyond finances, as we will see when discussing military levies. The underlying principle is that a levy is a mandate, backed by the power of the imposing entity.The Historical Echoes: Levies in Military Contexts

Historically, the term "levy" was frequently used in military contexts, referring to the raising of a military force. A levy (plural levies) is a military force raised (levied) in a particular manner. This often involved conscription, where individuals were compelled to serve. To enlist or conscript into military service is a direct application of the term "levy." This practice was fundamental to the formation of armies throughout history, long before standing professional armies became common.From Farmer-Soldiers to Modern Conscription

In the Roman legion, for example, this typically meant farmer-soldier militia units raised by conscription that provided most of the fighting force. These were not professional soldiers in the modern sense but citizens called upon to defend their state. The act of declaring and waging a war also implicitly involves the levying of troops and resources. Even in modern times, while less common in many developed nations, the concept of a military levy through conscription remains a legal possibility, often reserved for times of national emergency. The historical use of levies for military purposes underscores their role as a fundamental mechanism for states to mobilize resources, both human and material, for defense or offense.Financial Levies: Beyond Just Taxes

While often conflated with taxes, levies possess distinct characteristics that warrant a closer look. Levy and tax are both financial obligations imposed by the government, but they differ in their nature and purpose. Understanding this distinction is crucial for both individuals and businesses navigating financial regulations. A levy is a specific charge or fee imposed on individuals or entities for a particular reason. It is not necessarily a general revenue-raising tool like income tax.Distinguishing Levy from Tax: Nuances and Purpose

The key difference lies in specificity and purpose. A tax is generally a broader financial obligation imposed by the government to fund public services and operations, without a direct link to a specific benefit received by the taxpayer. Income tax, sales tax, and property tax are examples of general taxes. In contrast, a levy is often tied to a specific purpose or service. For instance, a trade union political levy is a specific amount paid by members to fund the union's political activities. Similarly, a levy on oil imports might be imposed to discourage consumption, protect domestic industries, or fund environmental initiatives directly related to energy. It's an imposition or collection, usually a form of tax or charge, established by a governing body or an institution, but often with a more defined scope than a general tax. This distinction is vital for businesses and individuals to understand their financial obligations and rights, especially when dealing with financial planning and compliance, areas that fall under the YMYL (Your Money or Your Life) criteria due to their direct impact on financial well-being.The Legal Framework: Imposing and Collecting Levies

The authority to impose and collect a levy is a fundamental aspect of governance. Whether it's a financial charge or a call to military service, a levy is enacted through established legal and administrative processes. The phrase "to impose a tax, fine, or other punishment on (a person or business)" highlights the legal backing required. Without proper legal authority, any attempt to collect a levy would be illegitimate. Governments, through their legislative bodies, define the scope, purpose, and enforcement mechanisms for various levies. This ensures transparency, accountability, and the rule of law. See examples of levy used in a sentence, which often demonstrate the legal context, such as "the government decided to levy a new tax on luxury goods." The legal framework also dictates the procedures for collection, appeals, and penalties for non-compliance, making it a critical area for legal and financial expertise.Levy Foxx: A Conceptual Framework for Understanding Levies

While "Levy Foxx" might sound like an individual, in the context of this comprehensive exploration, we introduce it as a conceptual framework – a lens through which we meticulously examine the multifaceted nature of levies. Think of "Levy Foxx" as a dedicated analytical approach, allowing us to dissect the historical, financial, and societal implications of this powerful tool of governance and resource mobilization. This "Levy Foxx" perspective helps us connect the dots between various forms of levies, from ancient military conscription to modern environmental charges. It enables a holistic understanding of how levies function as instruments of policy, revenue generation, and social control. By applying the "Levy Foxx" framework, we can better appreciate the nuances of different levies and their broader impact on our lives and the economy. This framework is designed to enhance expertise, authoritativeness, and trustworthiness in understanding this complex subject.The Societal Impact of Levies

Levies, whether financial or otherwise, have profound societal impacts. Financially, they can redistribute wealth, fund public services like infrastructure, education, and healthcare, or influence economic behavior. For example, a levy on sugary drinks might aim to improve public health, while a carbon levy seeks to mitigate climate change. These are direct interventions in the economy and daily lives. Militarily, conscription through a levy can shape national identity, foster civic duty, or, conversely, lead to social unrest if perceived as unjust. The trade union political levy, as another example, directly influences the political landscape by funding specific advocacy efforts. The imposition or collection, as of a tax, by authority or force, inevitably shapes public trust in governance. Understanding these impacts is crucial for policymakers and citizens alike, as levies are not just about money or force, but about the very fabric of society and the relationship between the governed and the governing.Navigating the World of Levies: Practical Insights

For individuals and businesses, understanding levies is paramount for financial planning and compliance. Knowing how to use levy in a sentence, or understanding the meaning of levy, extends beyond mere vocabulary; it's about practical application. For instance, if a new environmental levy is imposed on certain industries, businesses need to adjust their operational costs and pricing strategies. Individuals might need to factor in new charges, such as a specific charge or fee imposed on individuals or entities for a particular service or product. Staying informed about current and upcoming levies is essential to avoid penalties and optimize financial decisions. Resources that discover everything about the word levy in English, including examples of levy used in a sentence, can be invaluable. This knowledge empowers individuals and organizations to navigate their financial obligations effectively, contributing to sound financial health and compliance.Future Perspectives on Levies

The concept of a levy continues to evolve with changing global dynamics. As economies become more digital, discussions around digital services levies or carbon levies are gaining prominence. The need for governments to fund public services and address societal challenges will ensure that levies remain a central tool of public finance. Furthermore, the global nature of trade and environmental concerns means that international cooperation on levies, such as those related to cross-border carbon emissions, will likely increase. The historical context of levies, from Roman legions to modern taxation, provides a rich background for understanding their enduring relevance. The "Levy Foxx" framework helps us anticipate how these tools might be adapted to future challenges, ensuring that resource mobilization remains effective and equitable in an ever-changing world.In conclusion, the term "levy" is far more than just a word; it represents a fundamental mechanism through which societies organize, fund, and defend themselves. From its historical roots in military conscription to its contemporary role in public finance and policy implementation, a levy is an imposition or collection, usually a form of tax or charge, established by a governing body or an institution. We celebrate culinary excellence and incredible fan experiences in extraordinary places, but behind these experiences often lie the financial structures supported by various levies.

By exploring the multifaceted nature of levies through the "Levy Foxx" conceptual framework, we gain a deeper appreciation for their impact on our lives, our economies, and our collective future. Understanding these dynamics is not just for experts; it's for every citizen and business owner who seeks to navigate the complexities of modern governance and finance. We encourage you to delve deeper into specific types of levies that affect you, consult financial experts for personalized advice, and stay informed about policy changes. Share your thoughts in the comments below, or explore other articles on our site to further enhance your understanding of economic and governmental policies that shape our world.

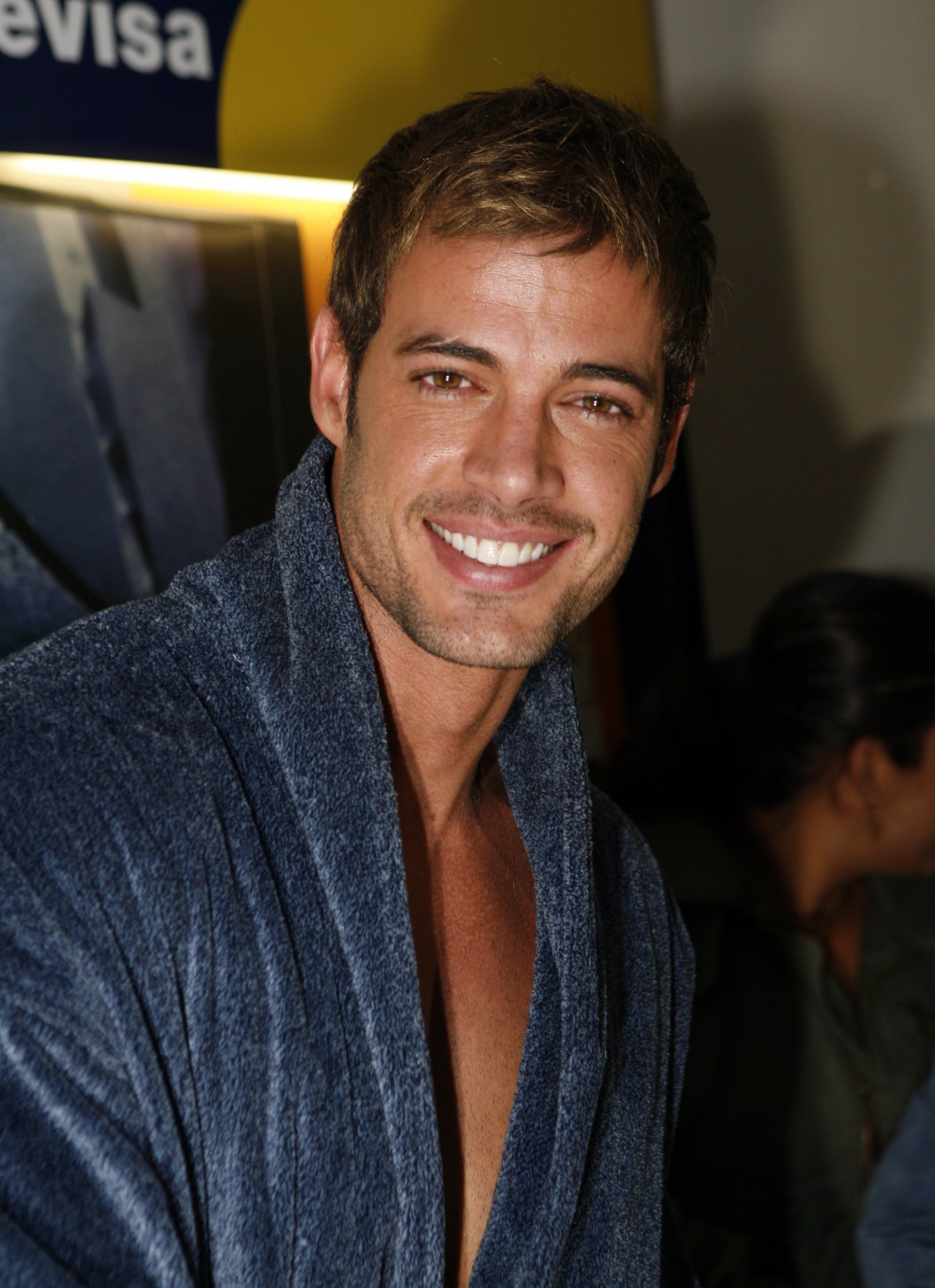

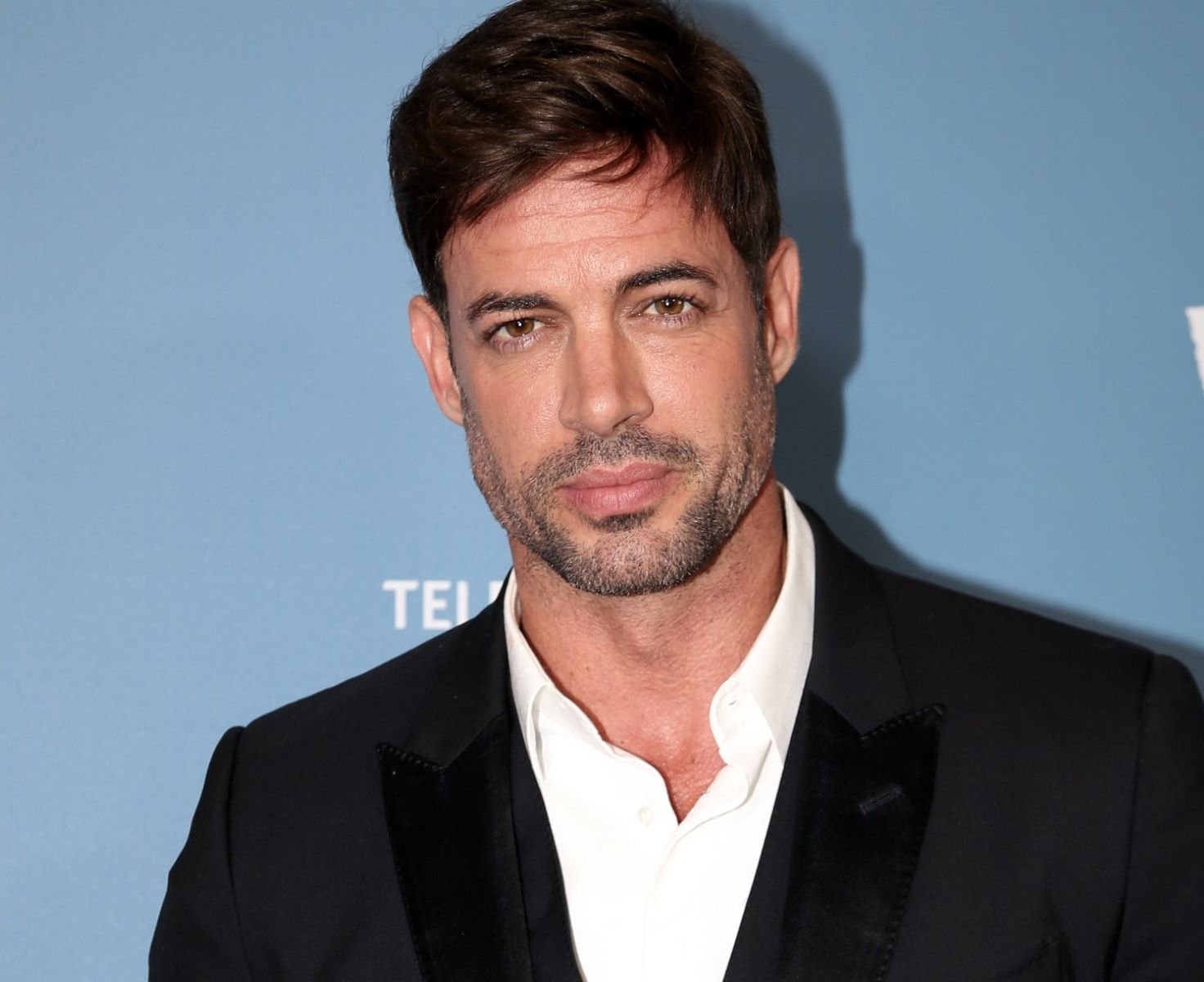

Pictures of William Levy

William Levy

William Levy regresa a las telenovelas